Your Salary in Germany After Tax: A Comprehensive Comparison

Like many families who made the decision to live abroad, we also had to look at what this relocation would mean for our finances. What would be your salary in Germany after tax? How would German taxes, social contributions and other costs affect your disposable income?

And although we have made quite a few videos discussing various aspects of the German social marketplace and benefits of living abroad…. we often saw feedback from our American friends saying “Yeah, well I make more money in the USA”.

And you’re not necessarily wrong… outside of the federal minimum wage (where it is higher in Germany) - Americans do have higher average incomes and lower taxes. But does that actually mean that Americans have greater purchasing power?

Because here’s the thing… While American taxes do contribute 1.4 Trillion into healthcare and another 202 Billion into Education… Americans still end up paying more out of pocket for the very thing that German taxes cover at nearly 100%

In the following blog post, we’ll track two scenarios - we’ll be contrasting the incomes, tax burdens, and payments to things like healthcare, public pensions like social security, unemployment insurance, and education - for a single worker in both the US and Germany, and for a family of four.

And at the end… hopefully have a final, definitive answer to the question: Who REALLY takes home more money at the end of the day?

Are you curious about how to get a work visa or residence permit to work in Germany? Take a look at our checklist here!

How Taxes Work in Germany vs. the United States

Before we can begin dissecting net wages, we need a brief primer for our taxes and social contributions in the respective countries.

At a very basic level, both US and German income tax is what is called a "progressive tax," which means that those who make more money pay a higher tax rate. If you make very little money, you pay no income tax at all. If you make a decent amount of money, you pay a fraction of it to the government. If you make a lot of money, the fraction you pay is theoretically higher. This system is designed this way because those who have enough money not to worry about putting food on the table each day can afford to pay more to the government.

That is the theory, at least.

And while the thresholds and progressive tax rates for these earnings differ between the USA and Germany - they are subject to many of the same rules. For example, there are different tax class filing factors and deductions that can change this dynamic in both countries… such as if you file a tax return as a single person, married filing jointly or married filing separately.

And in both the US and Germany, there’s a difference between a marginal tax rate and an effective tax rate. That's because when your income enters a higher tax bracket, only the income that falls into that higher bracket is taxed at the higher rate.

Now there are notable exceptions to this progressive tax rule… for example American "Social Security" and Germany’s Social contributions are actually considered a "regressive tax" because the more money you make, the less you pay. Those who make very little money have to pay the full percentage. Those who make decent money also pay the full percentage.

But when you make enough money, then you get to stop paying the tax after a certain point. This means that someone making a million dollars a year pays a tiny, tiny fraction of the percentage that almost everybody else has to pay.

It is worth mentioning that the difference between American private healthcare and German public healthcare is exceedingly fascinating. If you want to learn more, feel free to watch our video where we prepared a full analysis of healthcare contributions and benefits between Germany and USA.

But the major difference we want to point out is how Germany gives families and families with stay-at-home parents a sizable break in how much they pay for healthcare.

In general, in the United States, one parent will pay for the healthcare costs for their family. Their premium is entirely predicated upon how many dependents they are insuring. The more people (whether its kids or spouses) the more you pay.

But that’s not the case in Germany.

Your social contributions in Germany for public healthcare are a set percentage of your pay. Whether you have 2 or 12 children, you pay the same amount. And if your spouse is a stay-at-home parent who doesn’t have a taxable income, they are also included in that coverage at no additional cost. So you can already begin to imagine a scenario where large families under a single income start to see sizable savings over their American counterparts in this monthly expense.

So that’s why it’s important to not only provide a breakdown of wages, taxes, and out-of-pocket costs for single earners, but for families as well… because the dynamics change dramatically.

Understanding Euro & Dollar Exchange Rates

Next, the other major hurdle when comparing net wages between Germany and The United States, particularly when those two countries have different currencies, is the effect that the exchange rate plays in comparing relative wages.

Very quickly, exchange rates are defined as the price that one nation or economic zone’s currency can be exchanged for another currency.

And the values of domestic and foreign currency capture a lot of economic factors and variables and can fluctuate for various reasons… such as interest rates, inflation rates, government debt, political stability, export or import activities, recession, and speculation.

As you can see from this graphic, over just the past ten years this has fluctuated considerably between the US dollar and the Euro. March 2014, the euro was VERY strong. At that time, 1 Euro was equal to $1.40.

Which was fabulous if you were a German worker… because it meant that you had greater buying power if you wanted to travel in the US or have your gross annual salary converted into dollars.

But it was not great if you were an American traveling in Europe or… if you were my husband Jonathan, for example. We’ve shared before that he first moved to Germany in 2013. While not the all-time high, the euro was still very strong, so when his American employer converted his gross annual salary from USD to Euros… his relative wages went down because the dollar was weak. It wasn’t worth that much in Germany.

When he moved in May of 2013, the exchange rate for 1 Euro was $1.33. Now this wasn’t his actual wages, but for simplicity’s sake…. Had his earnings been an even $100,000 dollars in the US, when he moved to Germany and had his earnings converted… he was now only making 75,187.96 euros… not ALL employers will treat wages this way, but his did… and it hurt.

But things have changed significantly since 2013. Had he moved from the US to Germany in October of 2022, when 1 euro was only worth about 96 cents. That $100,000 gross annual salary in the USA would have converted to 104,166.66 euros here in Germany.

Now today while writing this article in December 2022, the exchange rate for 1 Euro is $1.06.

So while not quite 1 to 1 - it’s pretty close. Close enough to where you could probably just look at the straight numbers and still have a good reference of purchasing power. But throughout this article, I’ll still show conversions in both currencies for additional clarity.

USA & Germany Take-home Salary Examples

The easiest way to comprehend this thought experiment is to prepare four fictional scenarios. 2 single workers, one working in Germany and one working in the United States. The next are 2 families, with one in Germany and one in the United States.

Part 1: German & USA Wage Estimation

Alright, now that we have the formalities out of the way. Let’s get down to business.

For the first comparison, we’ll be examining wages, taxes and expenses for single workers in 2023.

USA Salary 1: Single Worker Named Steve

Age 23, single, No Kids

Occupation: Engineer

Bachelor’s Degree: Mechanical Engineering

2 years of Experience

Gross salary: $87,676 (~ 82,520 EUR)

(Source: https://www.indeed.com/career/engineer/salaries)

Divided into 12 monthly payments, he brings home a gross salary of $7,306.33 per month (€6.987,66)

American single worker Steve salary.

Germany Salary Scenario 1: Single-Worker Max

Age 23, single, No Kids

Occupation: Engineer

2 Years of Experience

Gross salary: €67.264 (~ $71,480 USD)

(Source: GlassDoor.de, 1-3 Years experience, Manufacturing)

Divided into 12 monthly payments, he bring home a gross net salary of €5.605,33 per month ($5,956.66)

German single worker Max salary.

We have used Indeed and Glassdoor as references for wages because they use reported data over multiple companies with self-reported wages in those countries to find an average gross annual salary.

Relative wages vary dramatically even by which city you happen to be working in…and that’s not something any one person can independently factor for when conducting an international comparison.

But what we can see is that even adjusted for the exchange rate - before net wage taxes, social contributions and out-of-pocket costs… Yes, Steve has a higher net salary than Max.

In this scenario, Steve makes about 18.5% more working in the United States as a mechanical engineer.

Now for the second comparison, we’re going to look at another American Steve and German Max, except these two workers are 15 years further down the line in their work experience and have different personal and financial dynamics in 2023.

USA Salary Scenario 2: Family

Steve - 38 (has now been promoted to Senior Engineer)

15 years of Experience: $154,527 (Glassdoor.com)

Stephanie - 36 (School Teacher)

15 Years of Experience: $68,693

Total Household Gross-Income : $223,220 (€210.080) or $18,601 per month

American family Steve & Stephanie salary before tax.

For future reference, Steve and Stephanie have two kids, Sam (age 4) and Sally (age 2). This will become important later on as we begin to calculate their out-of-pocket expenses in subsequent sections.

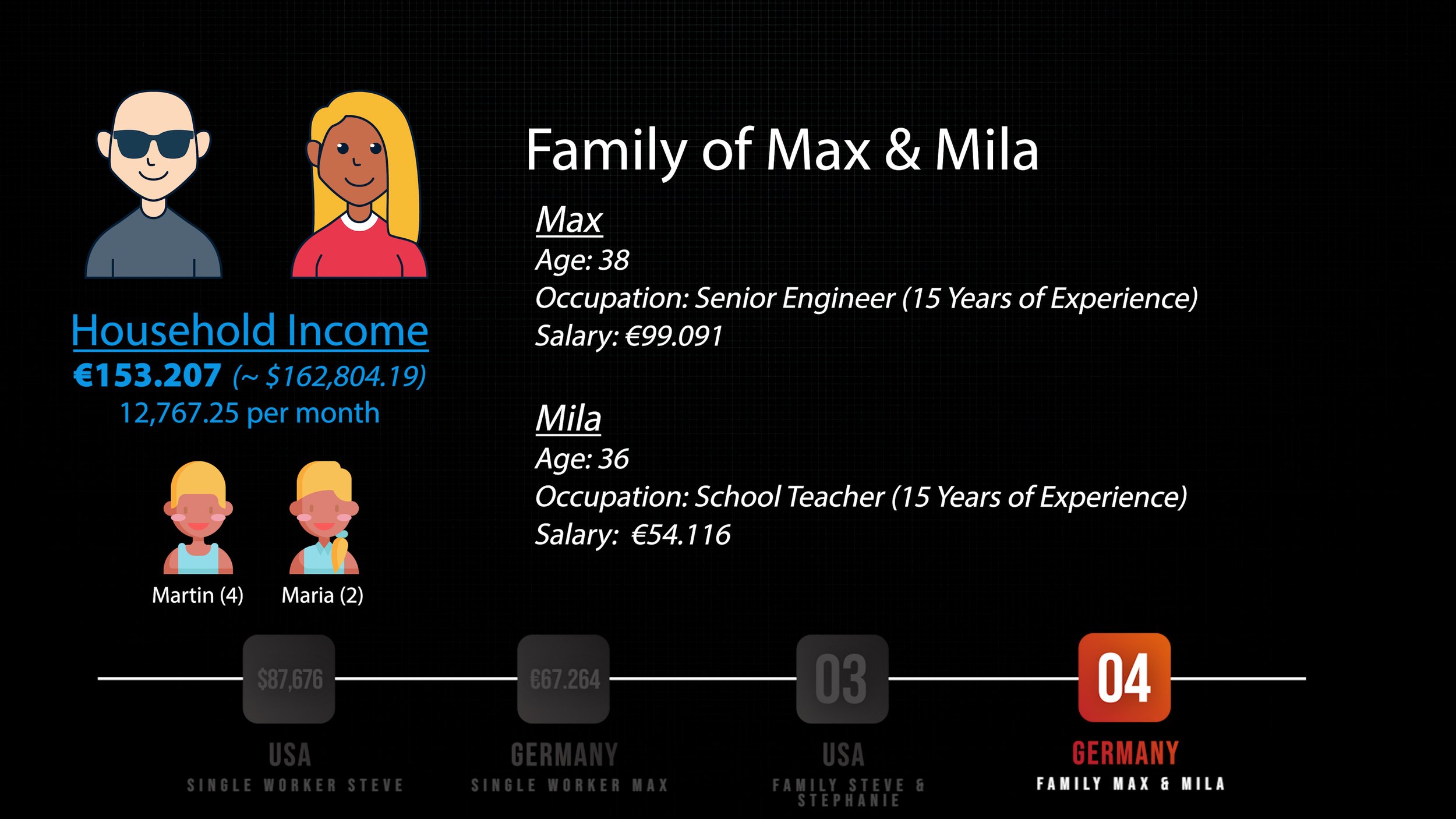

Germany Salary Scenario 2: Family

Max - 38 (has also been promoted to Senior Engineer)

15 years of Experience: €99,091 (Glassdoor.com)

Mila - 36 (School Teacher)

15 Years of Experience: €54.116

Total Household Gross-Income: €153.207 ($162,804.19) or 12,767.25 per month

German family salary before tax, Max and Mila with two kids.

And wouldn’t you know it, Max and Mila also have two kids: Martin (age 4) and Maria (age 2).

Once again, adjusted for the exchange rate - before wage taxes, social contributions and out-of-pocket costs… the American family has a significantly higher gross-income than the German family.

In this scenario, the American family makes about 27.1% more than the German family.

Part 2: Understanding Income Taxes & Social Contributions

In 1879 Benjamin Franklin famously is quoted as writing: “in this world, nothing is certain except death and taxes”.... And it very much still seems accurate. So, with this in mind - let’s go ahead and calculate the income taxes and social contributions owed in our two scenarios.

If you’re looking for a German tax calculator, we highly recommend using this. It’s what we used to write this article and vlog.

If you’re looking for a United States tax calculator, we highly recommend using this. It’s what we used to write this article and vlog, plus it lets you put in your exact working location!

Let’s start first with the single-workers:

USA Tax & Social Contributions: Single Worker Steve

Currently, 41 states and the District of Columbia levy a personal income wage tax. So for this calculation we are locating Single-worker Steve in Denver, Colorado. With a personal income tax rate of 4.55% it’s a bit below average, but it is a flat tax levied on all income groups, so it’s a bit easier to calculate.

For this calculation, we are presuming that Steve isn’t making a contribution to a 401k, ROTH IRA, or has any other itemized deductions. We will just keeping things simple here…. For now.

With a gross income of $87,676, Steve would have an effective federal tax rate of 13.75% and effective state tax rate of 3.77%. Between those taxes and payments to FICA (Federal Insurance Conributions Act, which funds Social Security and Medicare) - Steve paid $22,069 (just over 25%) in taxes and contributions - leaving him with a take-home pay of $65,607 (61.746,03 EUR).

American single worker Steve’s engineering salary detailed tax breakdown.

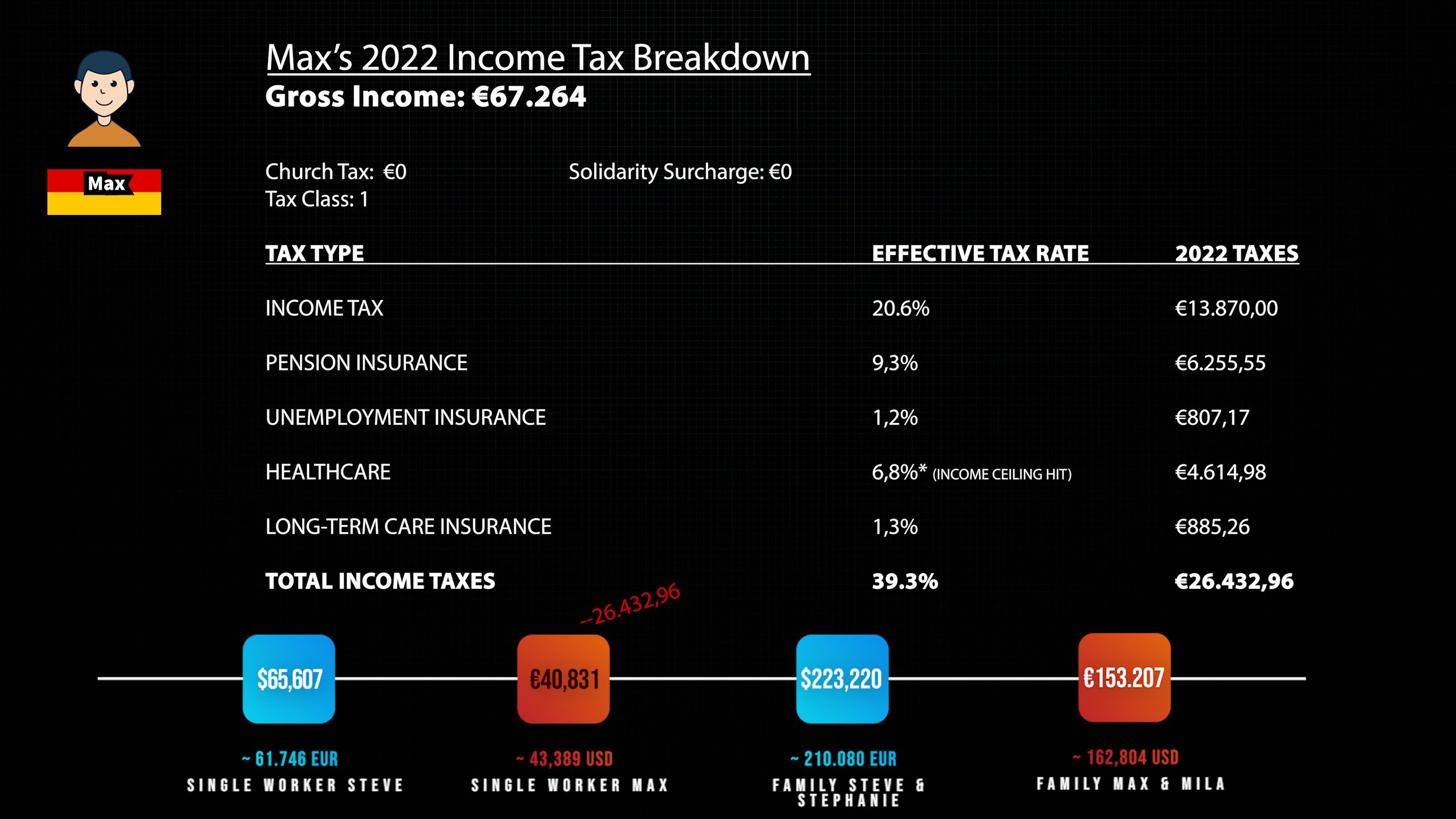

Germany Tax & Social Contributions: Single Worker Max

Now over in Germany, there are no local or state income taxes levied. However, those living in the former West Germany do pay something called a “solidarity surcharge” or (Solidaritätszuschlag) is a surcharge on income tax and corporation tax, introduced to meet the costs of German unification. And although it is currently 5.5%, from 2021, the solidarity surcharge will no longer be applied to income from natural persons with an income up to EUR 73.000,00 (EUR 151.000 for jointly taxable couples). So this does not apply to Max.

Like the majority of Germans, Max does not claim religious affiliation and does not pay church tax. And like our family, he is a member of the AOK health insurance which has an additional surcharge of 1,3%.

Assuming no other deductions, Max pays 13,870 euros in income tax and has roughly 39% of his income levied for either taxes or social contributions.

This gives him a net-income of 40,831 euros ($43,388.74) as take-home pay.

German single worker Max’s engineering salary detailed tax breakdown.

So yes, there’s a sizable gap in take home pay between Max and Steve… after taxes and social contributions, adjusted for the exchange rate… Steve makes nearly 44% more.

But what about families?

USA Tax & Social Contributions: Family of Four

For the American family of four, living in Colorado - their taxes probably look quite a bit like this. As a married couple with two children (giving them 4 personal exemptions). They’re paying just over $35,000 in federal taxes, another $12,351 in FICA, and 8,717 in State taxes.

At this time, we are only looking at the REQUIRED payments so we are not including 401K or IRA contributions in their deductions…. yet. You’ll have to stick around for that in a bit.

But what this means at the end of the day for the American family is that they’re still paying around 25% of their income in taxes and contributions because despite making a lot more money, having children dramatically changes their deductions.

Their take-home pay is roughly $167,124 (157.288,75 EUR).

American family Steve & Stephanie’s detailed tax breakdown.

Germany Wage Tax & Social Contributions: Family of Four

Now for the German family, assuming we are filing jointly and both Max and Mila are tax category 4.

With a joint income of €153.207, they did hit the married income threshold for solidarity surcharge, which cost them €110.35. Together, they paid 36,015 euros in income tax. An additional 12,900.59 went towards their pension insurance, 1,664.59 towards unemployment insurance, 8,927.20 towards health insurance, and 1,710.53 in long-term care insurance.

Together, the amount they paid in taxes and social contributions amounted to 62,147.01 EUR or an effective tax rate of about 40.5 % - leaving them with a take home pay of 91,058.66 euros (~ $96,762).

German family Max and Mila’s detailed tax breakdown.

So if we compare the US family to the German family, the US family pays less in taxes and earns more money at their jobs… leaving them with a LOT more in take-home pay.

But, stopping at this point in this analysis does not tell you the full story. While Single-Steve and the American family do have significantly more take-home pay… the Single-Worker Max and the German Family have already pre-paid for expenses with their social contributions that we have not yet calculated in the American scenario.

So… it’s time to take ALL of those into account.

Part 3: The Cost of Education in Germany & USA

The United States spends more per student on colleges and universities than nearly every other country in the developed world, according to the latest statistics released by the Organization for Economic Cooperation and Development (OECD).

If you want a more detailed breakdown between the US and Germany and the cost of higher education, we recommend watching this video we created:

But in summary, most American graduates have SOME help paying for college - whether it's through scholarships, grants, or financial help from their parents…. or a combination of all three.

But since the US does not have free University tuition, paid for with taxes, like here in Germany… We should presume that single-worker Steve, like the majority of American University graduates, has some student loans to pay off.

So to start, let’s take a look side-by-side at our single-workers, Steve and Max.

Max went to Uni in Germany and left with no student loan debt. But things are different for Steve. According to Sparrowfi - the Average student loan debt at the end of a 4-year mechanical engineering degree in the US is $23,000.

For our calculation, we’ll presume that Steve is on a standard 10 year repayment plan, with a current interest rate for federal student loans of 5%. This means he has a monthly payment of $243.95

Now at his income, Steve can deduct up to $2,500 of the amount of interest he paid during the year… which does reduce his taxable income. And presuming the repayment plan presented above at 5% interest - that does change our calculations a tiny amount, as he now has an additional 146.37 in student loan interest to deduct on his taxes.

At the end of the day, his take home pay goes down to $65,498 after the deduction, and with 12 student loan payments totaling $2,927.40… this further declines to $62,570.60 per year ($5,214.22 per month).

American & German compared salary after student loan payment.

Now let’s take a look at the side-by-side for our families.

Once again, both of our income earners in Germany benefited from low to no-cost college educations and left with no debt. They also get to benefit from this system when it comes to their children. Whether they pursue to technical, trade or University degrees, their taxes have helped to pay for their educations as well as contribute to the education of the entire community.

Now back in the United States - with 15 years of work experience, we will give the American family the benefit of the doubt that they stuck to their 10 year repayment plan and no longer have any outstanding student loans from their education.

However, they still need to make budgetary considerations for their children. While every family is different, and in the US there is no legal obligation for parents to pay for their child’s higher education.

But that being said, According to EducationData.org, nearly 2/3rds of American parents who expect their child to attend college are saving or creating plans to cover the costs. On average, parents save $5,143 annually for their kid’s college, with about 30% putting that money into what’s known as a 529 plan.

A 529 college savings plan works much like a Roth 401(k) or Roth IRA by investing your after-tax contributions in mutual funds, ETFs and other similar investments. Your investment grows on a tax-deferred basis and can be withdrawn tax-free if the money is used to pay for qualified higher education expenses. Contributions are not deductible from federal income taxes, however.

So with two little ones with futures to think of, let’s presume that Steve’s family is giving the average of $5,143 per child into a 529 plan. Again, while this doesn’t change their tax situation, it does reduce their disposable income.

Take-Home Pay Before: $167,124 ($13,927 per month)

Take-Home Pay After: $156,838 ($13,069.83 per month)

American family salary reduced after college savings for children.

Part 4: The Cost of Healthcare in Germany & USA

Next up is healthcare… and it's a big one. Wealthy countries, including the U.S., tend to spend more per person on healthcare and related expenses than lower-income countries. However, even as a high-income country, the U.S. spends more per person on health than comparable countries.

Prices are one of the most significant drivers of healthcare spending in the United States; the cost of healthcare services typically grow faster than the cost of other goods and services in the economy.

Yet despite the crushing effect that these costs have on the lives of Americans - the US is the only industrialized nation without universal health insurance. The Kaiser Family Foundation estimates the country’s collective medical debt is almost $200 billion.

There’s no way we could cover this subject comprehensively in this article - so if you want a full, detailed breakdown of the costs of public and private healthcare in the US versus Germany - please watch these videos:

As we mentioned earlier, both the German single-worker and the German families have already pre-paid their healthcare costs…. But if we are going to make a fair and balanced comparison we need to estimate those costs for the Americans.

And because the majority of Americans are not enrolled in Medicaid or Medicare, but are members of the private healthcare sector… I’ll be using an estimation of those costs.

When I worked for an American University, I was enrolled with a PPO plan through Blue Cross/Blue Shield of Kansas City. Although the copy of my HR briefing book is from 2014, I’m going to use it because it’s a real-world example of the costs associated with healthcare, and really… It was a pretty good plan as far as American coverage is concerned (again - watch that video above if you’d like a full explanation).

That being said, the dollar had an average inflation rate of 2.91% per year between 2014 and today, producing a cumulative price increase of 25.76%. So I’ll take those costs from 2014, and increase them by 25.76% to be balanced.

Scenario 1: USA Single-Worker Steve Healthcare Costs

Alright - So assuming Steve was offered the same PPO plan through BC/BS at his engineering firm, adjusted for inflation - his rates for his premium are really, pretty low, at just 55 dollars a month.

But from there… it’s there’s a LOT of factors that could change his financial situation. With this plan, Steve would need to hit a deductible of approximately $3,100 before his insurance even paid just 80% of the costs….assuming the doctor’s he sees are in network.

But you know, he’s a 23 year old guy… we’ll assume he’s pretty healthy and just account for the premium, a yearly doctor’s visit co-pay, and his twice-yearly dentist visit co-pay at $40 bucks a pop.

In the end, there’s not a HUGE change in his disposable income, just 780 bucks, but some.

US-SINGLE STEVE BEFORE: $62,570.60 per year ($5,214.22 per month)

US-SINGLE STEVE AFTER: $61,790.60 per year ($5,149.22 per month)

Single worker Steve’s updated salary after paying for health insurance.

Scenario 2: USA Family Healthcare Costs

For families in the US with private healthcare, however, things get quite a bit more expensive. So, let’s take a look.

Under this PPO plan, with inflation - a family health insurance premium would cost roughly $910.50 every month.

Under this plan, should they have any medical needs - they would have a deductible to hit first of approximately 1,250 dollars before insurance paid 80% of the costs… then a yearly out-of-pocket maximum of approximately $7,000 before 100% of the costs are covered.

For our German audience… This is why having a C-Section if you have a baby in the United States with private healthcare can and probably will still cost you thousands.

But again - we have four people here…and calculating their out-of-pocket expenses is tough because if you ALL are healthy… it's really just the premiums and co-pays… but if just one of you gets sick or has a chronic illness, or an accident…. You could pay a LOT more.

According to the Commonwealth Fund, the median yearly household spending in out-of-pocket costs in the State of Colorado in 2017, was $1,150 dollars.

So if we take this amount, plus 12 months of a $910.50 premium (10,926)…. We get a total of $12,076 in healthcare costs.

US FAMILY PAY BEFORE: $156,838 ($13,069.83 per month)

US FAMILY PAY AFTER: $144,762 ($12,063.50)

American & German family’s salary after paying health insurance.

Part 5: The Cost of Unemployment Insurance in Germany and USA

Next up is unemployment insurance. And all states in the U.S., excluding Montana, are what are termed ‘at-will’. Most do have exceptions, but the states of Florida, Alabama, Louisiana, Georgia, Nebraska, Maine, New York, and Rhode Island do not allow any exceptions.

And essentially what this means is that an employer can terminate employees for no reason, except an illegal one, or for no reason without incurring legal liability. At-will also means that an employer can change the terms of the employment relationship with no notice and no consequences. For example, an employer can alter wages, terminate benefits, or reduce paid time off.

In contrast… There are significant worker protections here in Germany. Someday, I’ll make a separate video on it… but it's VERY difficult to get fired here - and even in the consequence that your position is eliminated altogether… German citizens not only benefit from a continuation of healthcare coverage, but also benefit from robust unemployment insurance.

In short, your benefit will be 60% of your previous average wage (or 67% if you have children), up to a maximum of 7.050 euros per month in West Germany and 6.750 euros in East Germany.

Now the U.S. Department of Labor does have an unemployment insurance program…but it’s not much, by comparison.

Given Single-Worker Steve’s and Family Steve’s Incomes… it’s going to be between 280 bucks and 450 bucks a week…. about 15% of their wages.

So since this is another benefit that German workers pay for through social contributions, it's only fair that we ask that both our single and family workers in the US pay for as well with a supplemental plan….. Only problem is… these types of policies don’t REALLY exist in the US.

So honestly - the best protection is to build up a robust emergency fund through savings… something easier said than done, as it is reported in 2020 by the Federal Reserve that 37% of Americans would not be able to pay a $400 emergency expense without borrowing money or selling something.

But fair is fair. In Germany, unemployment insurance totals 1.2% of your gross-income. So while it’s not much and it won’t build up a saving’s account quickly… it’s something.

So for our US Single Steve, this is going to reduce his take-home pay by $1,052 - and bring down his disposable income to $60,739 (~ 56963 EUR).

For the family, 1.2 percent of their gross cumulative income is $1,838.48 - which will bring down their disposable income to $142,923.52 (~ 134,038 EUR).

Steve’s updated salary after paying for unemployment insurance.

US FAMILY BEFORE: $144,762 ($12,063.50) -($1,838.48)

US FAMILY AFTER: $142,924 ($11,919.57)

Updated American family salary after unemployment insurance.

Part 6: The Cost of Long-Term Care Insurance

Along the same lines of unemployment insurance, Germans also pay social contributions into long-term care insurance - which compensates you for loss of income and the cost of long-term nursing care, whether due to accident, illness or old age.

And what is really cool about this system, is that it's not JUST to help compensate for the cost of a traditional nursing home. It can also help to pay for the wages of a loved one to help take care of you at home. So if you’re a parent and one of your children develops a chronic illness or long-term disability, this can also be used to help to pay YOU and their care-giver.

It's pretty fabulous actually. And it makes it really difficult to find a comparable American plan. Yes, America does have Medicare…. but Medicare generally doesn't cover long-term care stays in a nursing home and it certainly isn’t as comprehensive as Germany’s plan.

So as the American population ages, more and more are taking out private long-term care insurance that is extremely similar to Germany’s… covering many types of long-term care, including both skilled and non-skilled care and even may include coverage for a range of services, like adult day care, assisted living, medical equipment, and informal home care.

Finding an estimate online is tough because most plans give quotes for older individuals and married couples starting around age 55. But since we are looking for a more comprehensive plan that goes beyond standard elderly care… we will do our best to give an “estimate” here.

According to the American Association for Long-Term Care Insurance and their 2022 Data and Statistics Report… a very basic yearly premium for a 55 year old, healthy single male is $950 and a single female at the same age is $1,500. Jump up just 5 years, and that plan is now $1,175 for a 60-year old male and $1,900 for a single 60-year old female. In other words, this shows about a 20% increase every 5 years….. So if we work backwards…. Taking a 20% regression every 5-years on the premium….

Single-Worker Steve could expect a yearly premium of just under 250 bucks ($249.03) and the family, and just under 1,000 dollars a year to insure both partners. ($437.76 + $547.2 = $984.96).

US-SINGLE STEVE BEFORE: $60,739 ($5,061.55 per month)

US-SINGLE STEVE AFTER: $60,489.97 ($5,040.83 per month)

US FAMILY BEFORE: $142,924 ($11,910.33)

US FAMILY AFTER: $141,939.04 ($11,828.25 per month)

Updated American family’s salary after paying long-term care insurance.

Part 7: Pension vs. Social Security Costs

In Germany, the statutory pension insurance benefit (gesetzliche Rentenversicherung) is paid out to individuals from retirement age and provides basic payments of around 70 percent of your working net income. Many Germans can opt to pay more into the pension system voluntarily to receive more benefits later on, they also may have a company retirement plan on top of this or select to purchase a “top up plan” to provide full replacement of their wages when they retire.

In contrast, the US social security replacement rate is around 40 percent. However, that proportion can vary widely depending upon how much you earned during your working years.

And now, this replacement rate shouldn’t be surprising…because Germans also pay more to support the system. In Germany, everyone must contribute 18.6% (employer and employee each bear a 9.3% contribution) of their net salary up to a maximum contribution ceiling (Beitragsbemessungsgrenze) of 7.050 euros in the old (western) federal states and 6.750 euros in the eastern states.

In contrast, in the United States, everyone must only contribute 12.4% (Employers and employees each only pay 6.2% of wages) up to the taxable maximum of $147,000 yearly net income in 2022.

Now there are a litany of retirement programs out there… from a 401(k) to ROTH IRAs those programs come with different tax deductions…. and how much you can afford to contribute is variable - so, ultimately it makes this comparison quite difficult.

So to be fair and transparent… we are only going to ask that the American workers contribute an additional 3.1% of their gross-income to retirement..and we’ll calculate this as a 401(k) because this is the most common type of employer-sponsored retirement plan in the United States and it helps with tax deductions.

For single-worker Steve, 3.1% of his gross income of $87,676 amounts to $2,717.96. However, as a 401(k) this reduces his taxable income and ultimately means that he has only $1,891 less each year in disposable income.

US-SINGLE STEVE BEFORE: $60,489.97 ($5,040.83 per month)

US-SINGLE STEVE AFTER: $58,598.97 ($4,883.25 per month)

For the US family, 3.1% of their joint income amounts to $6,919.82. But again, as a 401(k) this reduces their taxable income and ultimately means that they see only $4,954 less each year in disposable income.

US FAMILY BEFORE: $141,939.04 ($11,828.25 per month)

US FAMILY AFTER: $136,985.04 ($11,415.42 per month)

Updated American family’s salary after retirement savings payment.

Part 8: The Cost of Childcare in Germany & USA

As one final category… we would like to include something that may seem like a bit of a curve ball.

Childcare costs aren’t something that is directly listed on the “social contributions” but, just like higher education, it is nonetheless part of the socialized system here… because in Germany, the holistic education and upbringing of your child is a community endeavor… so it makes sense that community funds should be used for it.

This thinking has caught on somewhat in the US. While there are already four states in the US with free pre-K for 3 and 4 year olds, there was a big push last year under the Biden Administration to try to pass a bill guaranteeing free pre-k nationwide. It ultimately failed to happen, but it was the first time in my memory that a discussion of universal pre-primary school education and care has been discussed on a national level.

Nonetheless, for this comparison this obviously doesn’t impact the finances for our single workers… but it makes a HUGE impact on the finances for our families.

Should Max’s family be located in Berlin, Kita and Kindergarten is free for his two kids. He and Mila would be expected to pay nothing except for food, which usually costs 23€ per month per child.

In addition, while our American family benefited from their two children with a tax deduction, we have yet to calculate an important benefit that Max and Mila receive: Kindergeld. At 250 euros a month allowance PER child until the age of 18, our German family receives 500 euros every month, tax-free to help offset the costs of raising little ones.

On the flip side of things, Steve and Stephanie also have two small children, one in day-care and the other in pre-k.

For full-time, full-day care in Denver, the average cost is $1,575 per month. For Pre-K the costs are slightly less… but not much, as the average cost is $1,539 per month for full-time, full-day programs.

To be fair, if your two kids go to the same facility, often these companies will offer what they term a “sibling discount.” In Denver, the sibling discount ranged from 5% to 50%, but mostly commonly, the source we used, which analyzed the rates all the way down to differences by zip code and neighborhood, saw 10% to be the standard for the second child.

So we could safely presume that our American family is paying a whopping (1,417.50 + 1539 = $2,956.50 per month in childcare alone).

Spread out over 12 months and you can see the dramatic effects. ($35,478)

US FAMILY BEFORE: $136,985.04 ($11,415.42 per month)

US FAMILY AFTER: $101,507.04 ($8,458.92 per month)

Updated American family’s salary after paying child care.

Part 9: The Final Take Home Salaries in Germany & USA

Alright - so if you’re still here and don’t have a headache from all of the numbers… Here’s the final result.

As a Single Worker…. At the end of the calculations, you’re still significantly better off in the States in terms of income.

Steve ended up with a take-home pay of $58,599 (€54.799) or $4,993.25 per month, while Max goes home with just 40,831 euros ($43,388.74) or $3,402.58 per month.

Estimated salary after tax, insurance & social contributions of American and German engineers.

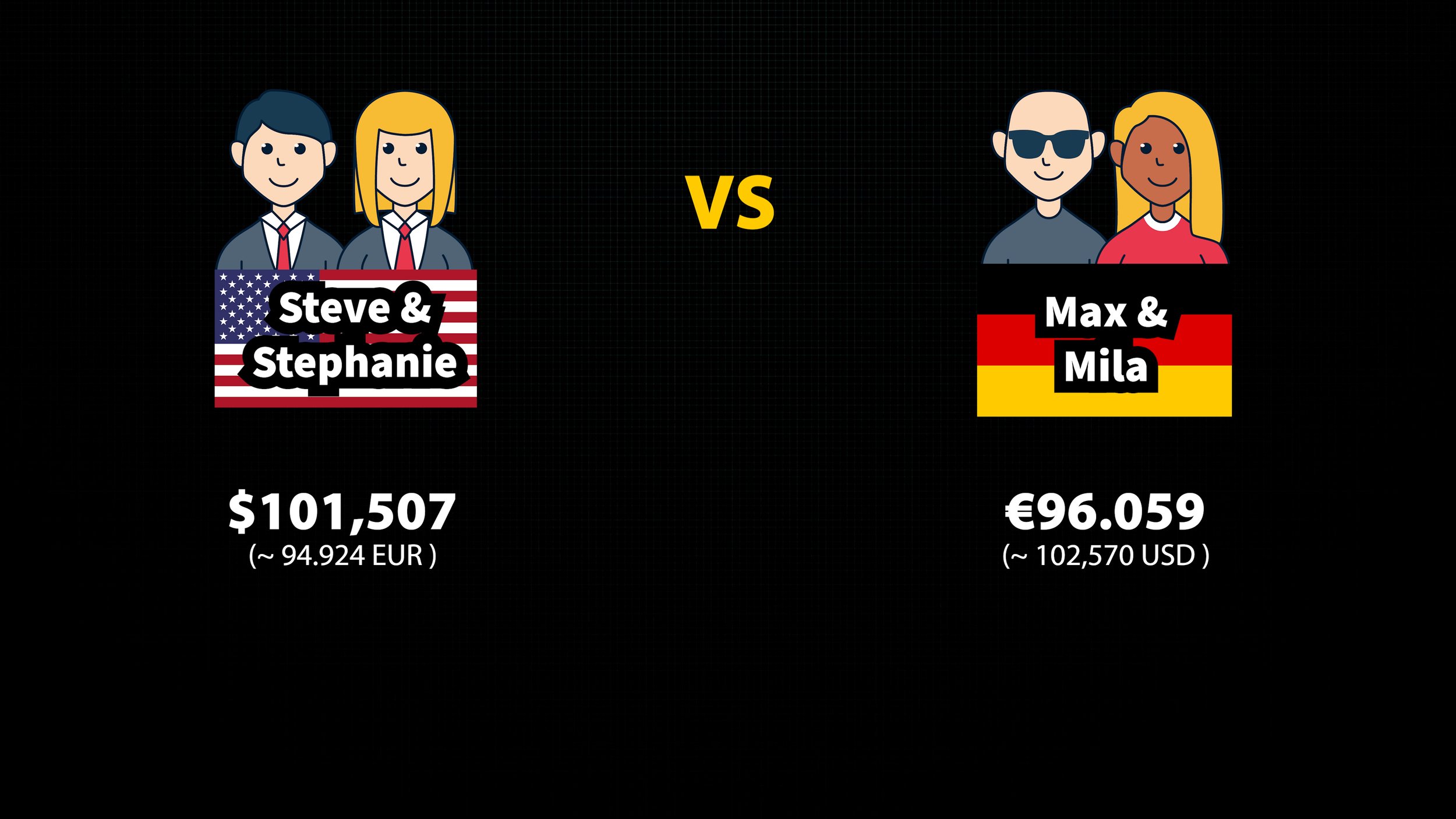

On the flip side of things… the families saw a much, much closer final outcome.

Steve and Stephanie ended up with a take-home pay of $101,507 per year (~ €94.924) or $8,458.92 per month.

While Max and Mila ended up with a take home pay of 96,058.66 euros (~ $102,570) or €8.004,98 per month.

Estimated salary for American and German families after tax, insurance & social contributions.

So here, although it’s a smaller margin - the German family comes out ahead.

But here’s the thing…. change the exchange rate to even just a couple of years ago… and this dynamic changes dramatically with the German families coming out with even more relative wages, and the German and American single-workers being dead even.

This exercise illustrates two important things:

First, While wages are higher and taxes are lower in the US… at the end of the day, when you take into account all of the out-of-pocket costs, the difference isn’t as significant as many think it is. We actually live pretty similar lives when it comes to take-home pay.

And second, many Americans really need to think long and hard about what those statutory contributions or as they like to simplify “Socialist Taxes” actually end up really buying you… and that’s guaranteed peace of mind.

Because while we might be able to sit here and calculate all of the theoretical voluntary payments you’d need to make to cover things like losing your job, getting sick with cancer and not being able to work, or even just getting old and going into a nursing home…. The reality is the VAST majority of Americans aren’t budgeting for those things… and America sees vastly greater rates of personal bankruptcy, and lower rates of average household wealth than Germany because of it.

And while we might even agree that American healthcare is really, really great in terms of offering the best and fanciest care available… just know that you’re making the Lamborghini argument.

Yes, although they may still seat 5 passengers, a Lamborghini Urus is a better and fancier car than a Volkswagen Tiguan. But presuming that the average family should be able to afford that car to meet their basic needs is ludicrous.

Most would agree that they would rather see everyone in their community have free access to a Tiguan through paid taxes, than see programs like Go-Fund me attempt to crowd-source fund a Lambo.

Buying Power in Germany And USA?

It’s also important to understand what this salary actually means. How much buying power do you have in Germany or the United States? We have covered that in detail with the same fictitious familes. Give it a watch here!